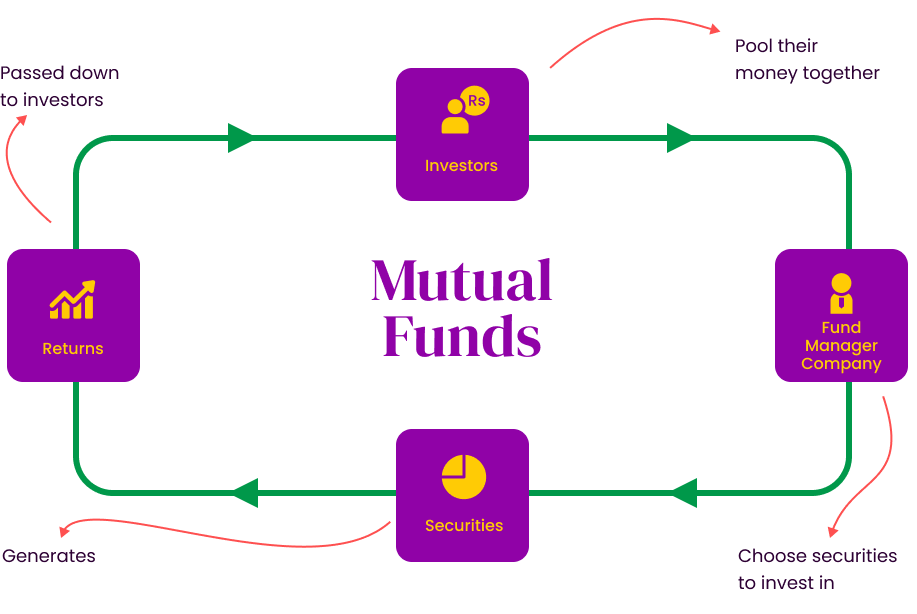

A Mutual Fund is a single portfolio of investments where investors put their money to be managed by an asset management company on behalf of its many investors. This allows each investor access to a professional managed pool of funds.

Individuals and corporate investors can invest directly, without professional oversight, in the market. However, they may face the following constraints:

While reviewing your mutual fund options, be sure to evaluate your:

What do you want from your mutual fund investment? Are you saving for your retirement, your children’s college or investing money for future generations? The answers to these questions can help you narrow down which funds would work best.

Mutual funds are typically better suited for long term investors. If you think you will need your money in the near future, say within three to five years, then a mutual fund may not be the best option. This is because the return in that amount of time, once removing the cost of fees, may not be enough to make the investment worth it.

Determine how comfortable you are with risk and invest accordingly. Understanding your risk tolerance can help you select funds with strategies and asset allocations that fit this profile.

Mutual fund investing provides significant benefits, particularly for individuals who prefer to avoid direct involvement in the demanding and time-consuming tasks of researching companies, placing trade orders with brokers, and monitoring stock price fluctuations.

Identify your financial goals and related investment objectives. For example, for a retirement goal, that may be 15 years away, capital growth would usually be the investment objective. But for a retired person, generating regular income could be the objective. Similarly, other financial needs require identifying relevant investment objectives.

Choose a mutual fund that suits your investment objective.

Make your investment in the chosen mutual fund. You will receive units which will represent your investment in the fund. The number of units you get will depend on your investment amount and the NAV on the day you make the purchase.

Number of units you get = Your investment value / NAV on the day you make the purchase

Each mutual fund scheme adheres to a specific investment objective while investing the money collected from investors. The investor is allotted units for his investment amount depending on the prevailing NAV of the fund.

The value of each unit of the fund is calculated based on the current market price of all the assets held by the fund. This price is called the Net Asset Value (NAV) of the fund.

The total of assets held by the mutual fund at any point of time is called its Assets under Management (AUM). At launch, the AUM is equal to pooled funds collected from the investors. As time passes, funds are invested in assets whose value changes on daily basis reflecting in profits/losses. At the same time, new investments keep coming in, and existing investors redeem or dividend is paid to them.

Like any other market linked investment, mutual funds too are subject to price fluctuation, liquidity, credit risks, etc. Mutual funds however, minimize these risks through diversification and professional management. Performance of mutual funds is dependent on the investments in the portfolio.

Your optimal mutual fund portfolio will depend on your investment goals, your time frame, and your risk tolerance.

Why are you investing? People invest for a lot of good reasons:

Before you invest, you need to ask yourself what you want to accomplish.

How much time till you will need the money? By dividing your goals into long and short-term, you will make selecting the right investments a lot easier:

How much risk are you willing to take? Every investment involves some degree of risk. You have to decide how you feel about risk:

The main thing is that you find a comfortable balance between potential risk and potential earnings.

Open-end funds continually create new units or redeem issued units on demand of investors. The unit holders can buy the units of the fund or redeem them on a continuous basis at the prevailing Net Asset Value (NAV) by simply contacting the Asset Management Company (AMC) and the AMC will facilitate in the particular transaction.

Closed-end funds have a fixed number of shares outstanding and do not redeem if investors want to sell; instead, the shares trade in the secondary markets (stock market, e.g. PSX).

Its market price is determined by demand and supply and is not directly tied to its net asset value. In order to buy or sell units of a close ended Mutual Fund, the investor shall need to contact the broker and not the AMC.

The objective of equity funds is long-term growth of capital by investing in stocks.

Because stocks are generally more volatile than other type of investments, equity funds (which are usually composed entirely of stocks) may exhibit short-term fluctuation and therefore carry a higher level of risk. Investors need to be prepared to tolerate this higher risk. Equity funds could be a good investment if you have a long-term perspective and can stay invested for at least three years or perhaps even longer.

Equity funds primarily invest in stocks of companies as per the investment objective and philosophy.

The objective of balanced fund is to generate long term capital appreciation as well as current income from a portfolio comprising of both equity as well as fixed income securities.

Balanced funds which have a combination of both equity and fixed income instruments, tend to provide investors with a moderate level of risk exposure. Balanced funds are ideal for those looking for income and growth over medium to long-term investment horizon.

Balanced funds primarily invest in equities as well as in fixed income instruments.

The objective of index tracker funds is to provide investors an opportunity to track closely the performance of an Index by investing in proportion to the constituent securities found in the index. Being a passive fund, it charges lower management fee from unit holders vs. a pure equity active fund.

The Fund is suitable for investors who may simply wish to mirror the risk and return profile that is achieved by investing in any particular index.

Index Funds that track an equity index, simply aim to mirror the return of the subject index. It must be noted that these are risky investments, since the underlying securities are usually equity securities with their inherent volatility intact. However, the fund manager has no discretion on the choice of security, other than to passively invest in the constituent equity securities in the weightages, as found in the subject index.

Index funds are 100% replica of a particular index.

The objective of income funds is to have a regular stream of income by investing in debt securities that have the potential to provide a higher level of regular income than money market funds and may also generate reasonable capital growth.

Fixed income funds are usually safer investment avenues than stock funds, but maybe slightly more riskier than money market funds. As is the case with other Fixed Income securities, their prices and performance is heavily dependent on the level and change in interest rates (and other market conditions). These are usually suitable for investors who want to avoid the high volatility experienced in the stock market.

Fixed income funds primarily invests in Govt. Securities, Banks, Sukuks, TFC, TDR, CFS, Certificate of Musharka, Spread Transactions etc.

The objective of money market funds is to invest in low risk avenues.. These funds aim to preserve your original investment and achieve target returns with high certainty and low risk factor by investing in investment instrument with low risk and lower volatility.

Money market funds are considered fairly safe and appropriate for investors who want to limit risk or who are investing for a short period of time and want ready access to their money. Money market funds have very low risk of losses in principal invested along with higher certainty of target return achievement.

Money Market funds primarily invests in highly rated Govt. Securities, Banks, Sukuks, TFC, TDR, CFS, Certificate of Musharka, etc

The objective of an asset allocation fund is to generate returns by investing in a mix of equity and debt securities (or any other asset class that may be included as well).

Asset allocation funds are suitable for investors who have the comfort on the fund manager to prudently switch between the various asset classes, as per market outlook.

Asset Allocation funds usually shift their exposures between debt and equity (and/or any other asset class) as per the outlook on the market.

The investment objective is to protect Initial Investment Value along with the prospect of growth upon the initial investment over the stipulated time period.

Capital protected funds are suitable for investors who do not wish to take any significant risk and are seeking the potential for improved returns above those available on money market/debt funds or bank deposits. They seek participation to equity markets with the assurance that their initial principal is protected or safeguarded.. Feature of capital protection is normally offered if the investment is held till maturity.

Capital protected funds give you 100% capital protection, with the potential to earn a return that is better than that being offered by bank deposits or money market funds/ instruments. In order to achieve their objective they may seek to cash-in on any stock market upside that may be witnessed during the tenure.

The investment objective is to provide participants a regular income at the time of retirement and at an age when one’s capacity to work is diminished, so that one is not dependant on other members of the society.

Voluntary Pension schemes in Pakistan normally have 3 sub- funds and based on these sub-funds offer various attractive allocation schemes. Each scheme may carry a varying level of risk. For a participant investment risk range from low to high (depends on the chosen asset allocation).

Investor can choose from a wide range of investment options depending on retirement goals, age and appetite for risk. Contributions will be invested in the particular scheme.

Meezan Pakistan Exchange Traded Fund is a Shariah Compliant Exchange Traded Fund that aims to provide investors an opportunity to track the performance of Meezan Pakistan Index that has been constituted and is maintained by the Management Company, and comprises of Shariah compliant equity securities selected with high consideration towards market capitalization and traded Value.

Exchange Traded Funds are suitable for investors who have the ability to take the risks associated with financial market investments.

The Index will consist of selected liquid stocks in accordance with KMI-30 index, which will be derived through the security selection criteria, in order to achieve the investment objective. The Management Company shall aim to maintain an aggregate number of 12 stocks in the Benchmark Index, if the below-mentioned criteria permit.

The objective is to provide investors with a competitive rate of return, for fixed tenure by investing primarily in Shariah Compliant TDRs and money market placements / Instruments for a specific duration.

Very Low

Exchange Traded Funds are suitable for investors who have the ability to take the risks associated with financial market investments.

Fixed Term Funds primarily invest in Shariah Compliant TDRs and money market placements / Instruments for a specific duration.

Aims to provide maximum exposure to prices of Gold in a Shariah Compliant (Islamic) manner, by investing a significant portion of the Fund’s net assets in deliverable gold based contracts available on Pakistan Mercantile Exchange (PMEX).

Exchange Traded Funds are suitable for investors who have the ability to take the risks associated with financial market investments.

Islamic Commodity Funds primarily invest significant portion of the Fund’s net assets in deliverable gold basedcontracts available on Pakistan Mercantile Exchange (PMEX).

The mutual fund incurs certain recurring expenses for managing the scheme which is charged to the scheme. Some of these expenses are: