Capital Preservation Solutions

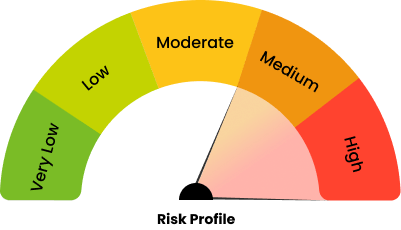

Capital preservation funds are schemes which aim to preserve your principal while offering potentially high returns, through dynamic allocation. The dynamic asset allocation is aimed at providing higher returns through participation in Equities, while aiming to protect downside risk of capital through participation in Income/Money Market instruments.